Hours used to calculate annual salary

Wage and salary costs averaged 2719 and accounted for 704 percent of employer costs while benefit costs were 1142 and accounted for 296 percent. Geographic Information from the Quarterly Census of Employment and Wages.

17 An Hour Is How Much A Year Can I Live On It Money Bliss

Calculate the number of hours worked per year.

. It takes into account a number of factors such as tax rates in Malta Social Security SSCNI contributions and government bonuses. Follow the instructions below to convert hourly to annual income and determine your salary on a yearly basis. While there are 52 weeks in a year this accounts for 2 weeks of vacation time.

You can calculate your salary on a daily weekly or monthly basis. Lets say Chris has a 75000 annual salary from working a regular job. Employees who earn a wage are paid based on a rate that is multiplied by the number of hours or days they worked during a period.

HR maintains financial records of employees like wages salaries deductions bonuses holidays leaves sick leave etc. Total compensation costs for private industry workers were 1497 at the 10th wage percentile 2860 at the 50th median wage percentile and 7446 at the 90th wage percentile. Plug in your total gross salary before any deductions are taken.

Dividing the total yearly salary by 12 will give you the gross pay for each month. Then multiply this value by the number of days off you receive per year. Fortunately if you find yourself in one of these situations theres a formula that you can use to calculate how much you should be compensating your employee before they go on holiday.

How to calculate gross salary and net salary. This one should be pretty straightforward. Multiply the number of hours worked per week by 50.

Salary in lieu of notice of termination of service. A salary sheet or payroll sheet is the Human Resource document that a company uses to calculate the salaries of their employees. For the salary calculation and after tax illustrations.

Working hours in Japan Working hours in India. The individuals gross income every two. To convert salary into hourly wage the above formula is used assuming 5 working days in a week and 8 working hours per day which is the standard for most jobs.

Double the hourly pay move the decimal point 3 places right. Is your annual salary before tax. To understand the calculation of gross salary and net salary better let us take the help of an example.

The chart below shows the annual average of the length of a working week in the United States for all employees from 2007 to 2019. Annual and quarterly wage data are available by detailed industry for the nation states counties and many metropolitan areas. Salary deduction for unauthorised absence from work.

Semi-Monthly A semi-monthly payment frequency results in 24 total paychecks per year. When the number of hours worked in the day is 5 or less. Works drastically different hours each week for whatever reason.

To figure out how many hours are in a work year multiply the number of work hours in a week by the number of. Multiply biweekly pay by 26. To calculate his gross annual income Chris adds these four amounts together.

Hourly Compensation and Unit Labor Costs. According to our findings we would need to pay 42251 for an employee with a base salary of 30000 which means we need to add to that base salary 12251 to cover taxes and benefits. And Expenses period is Annual meaning the amount you entered as your Employment Income in the Netherlands.

25 days holiday per annum refers to the number of holidays you receive per year. The Konnekt salary and tax calculator is a new simple tool that gives you a comprehensive overview of your salary while employed in Malta. Arun works at an IT firm.

Per annum on the other hand refers to the time frame of each year eg. Hourly jobs pay per worked hour. The hourly wage calculation may differ slightly depending on the worked hours per week and the annual vacation allowance.

Divide daily pay by 4 move the decimal point 3 places right. How to Calculate Total Work Hours in a Year. This is equal to 37 hours times 50 weeks per.

His gross salary per anum is Rs 620000 while his net take-home is just Rs 593000. To convert salary into hourly wage the above formula is used assuming 5 working days in a week and 8 working hours per day which is the standard for most jobs. The hourly wage calculation may differ slightly depending on the worked hours per week and the annual vacation allowance.

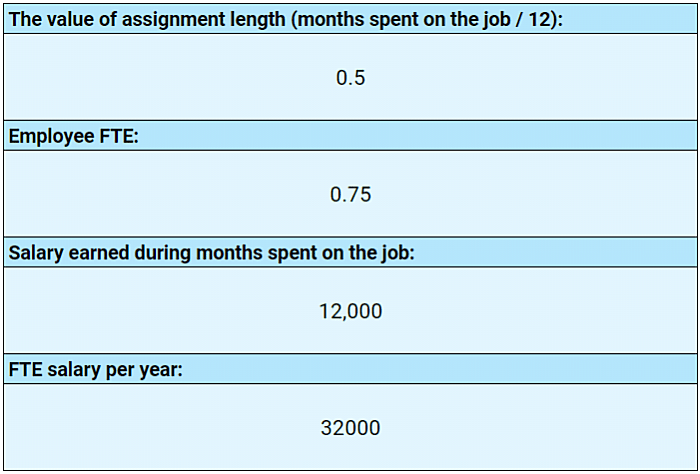

This means an employee who works 80 hours per month at a company whose full-time hours per month totals 160 would have an FTE of 05 80 160 05. Usually a monthly payment frequency is used for salary employees but hourly employees can be paid monthly as well. US Tax Calculator and alter the settings to match your tax return in 2022.

The yearly salary will be divided by 24 to get the payments. In addition to his yearly salary Chris makes 1000 per year in interest from his savings account 500 per year in stock dividends and 10000 per year from rental property income. State and metropolitan area estimates of hours and earnings are also available.

For Gross rate of pay its use to calculate. Gross earnings at the end of the last pay period - one-off or irregular payments 4. This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate you are paid per hour.

Here are some shortcuts to approximate annual income. Paid Vacation Time PTO To calculate the value of your time off divide your salary by 260 to calculate your average pay per day. To calculate an employees FTE based on monthly or annual totals you divide the employees actual hours scheduled for the month or year by the number of full-time hours in the month or year.

First calculate the number of hours per year Sara works. For example if an employee working 20 hours per week is paid 12 dollars per hour the annualized salary is 20 hoursweek x. Salary in lieu of annual leave.

The reduction in your salary when you work 20 fewer hours. Divide weekly pay by 2 move the decimal point 2 places right. Pro rata refers to the proportional reduction in something based on the amount used consumed or worked eg.

That amount is about 40 of the total annual cost which is pretty close to the upper end that Hadzima 42000 estimates for a base salary of 30000. Multiply total hours by the hourly salary. Lets take a look at his salary components.

This 56k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses West Virginia State Tax tables for 2022The 56k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of West Virginia is used. For example an employee who earns an annual salary of 50000 is paid the same amount every two weeks regardless of how many hours they worked each day in those two weeks. Multiply monthly pay by 12.

It is also known as payroll or payroll sheet. Number of hours worked per week The number of hours worked in the year is used to calculate average daily weekly hourly earnings etc.

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator

Gross Income Formula Step By Step Calculations

Hourly To Salary Calculator

What Is Annual Income How To Calculate Your Salary

Hourly To Salary Calculator Convert Your Wages Indeed Com

Hourly To Salary Calculator

Salary Formula Calculate Salary Calculator Excel Template

Salary To Hourly Salary Converter Salary Hour Calculators

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Salary Calculator

Salary Formula Calculate Salary Calculator Excel Template

4 Ways To Calculate Annual Salary Wikihow

Hourly To Salary What Is My Annual Income

Hourly Income To Annual Salary Conversion Calculator

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog